Bi weekly paycheck calculator massachusetts

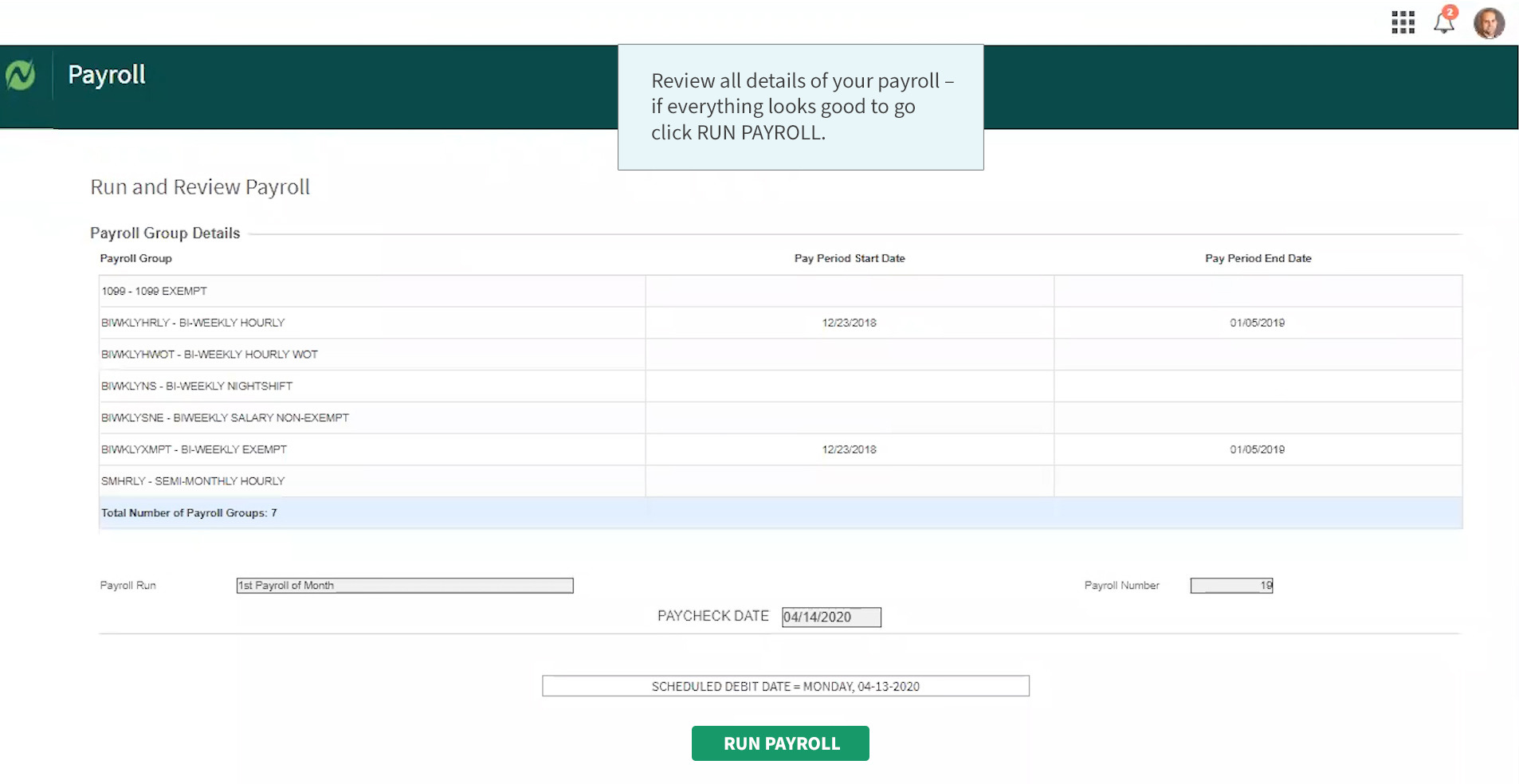

Examples of pay periods are. Payroll taxes change all of the time.

Free Net Pay Calculator

This bonus tax aggregate calculator uses your last paycheck amount to apply the correct withholding rates to special wage payments such as bonuses.

. Get the latest financial news headlines and analysis from CBS MoneyWatch. BI-WEEKLY 80 HRS 26 Pay Periods Paid Every 14 Days. Subtract any deductions and payroll taxes from the gross pay to get net pay.

How Your Vermont Paycheck Works. Monday February 21 Memorial Day. With our secure online paycheck system paying your employees has never been easier.

We encourage you to talk to an investment professional about your situation. The frequency of your paychecks will affect their size. Use Before 2020 if you are not sure.

Try Free Pay Stub creator to generate paystubs without Watermarks online include all company employee income tax deduction details. This tool has been available since 2006 and is visited by over 12000 unique visitors daily and has been utilized for numerous purposes. We have designed this free tool to let you compare your paycheck withholding between 2 dates.

Subtract any deductions and payroll taxes from the gross pay to get net pay. Martin Luther King Jr. Easy to use quick way to create your paycheck stubs.

Paycheck Manager offers both a Free Payroll Calculator and full featured Paycheck Manager for your Online Payroll Preparation and Processing needs. There are multiple ways to adjust your tax withholding. Monday May 30 Juneteenth National Independence Day.

The PaycheckCity salary calculator will do the calculating for you. Dont want to calculate this by hand. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year.

This lets us find the most appropriate writer for any type of assignment. Switch to Massachusetts salary calculator. Overview of Massachusetts Taxes.

Federal Paycheck Calculator Calculate your take home pay after federal state local taxes Updated for 2022 tax year on Aug 02 2022. Free paystub maker tool is specially designed to generate printable pay stubs in PDF format at your Email for easy download share online without repaying. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year.

Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. Dont want to calculate this by hand. Financial advisors can also help with investing and financial plans including retirement homeownership insurance and more to make sure you are preparing for the future.

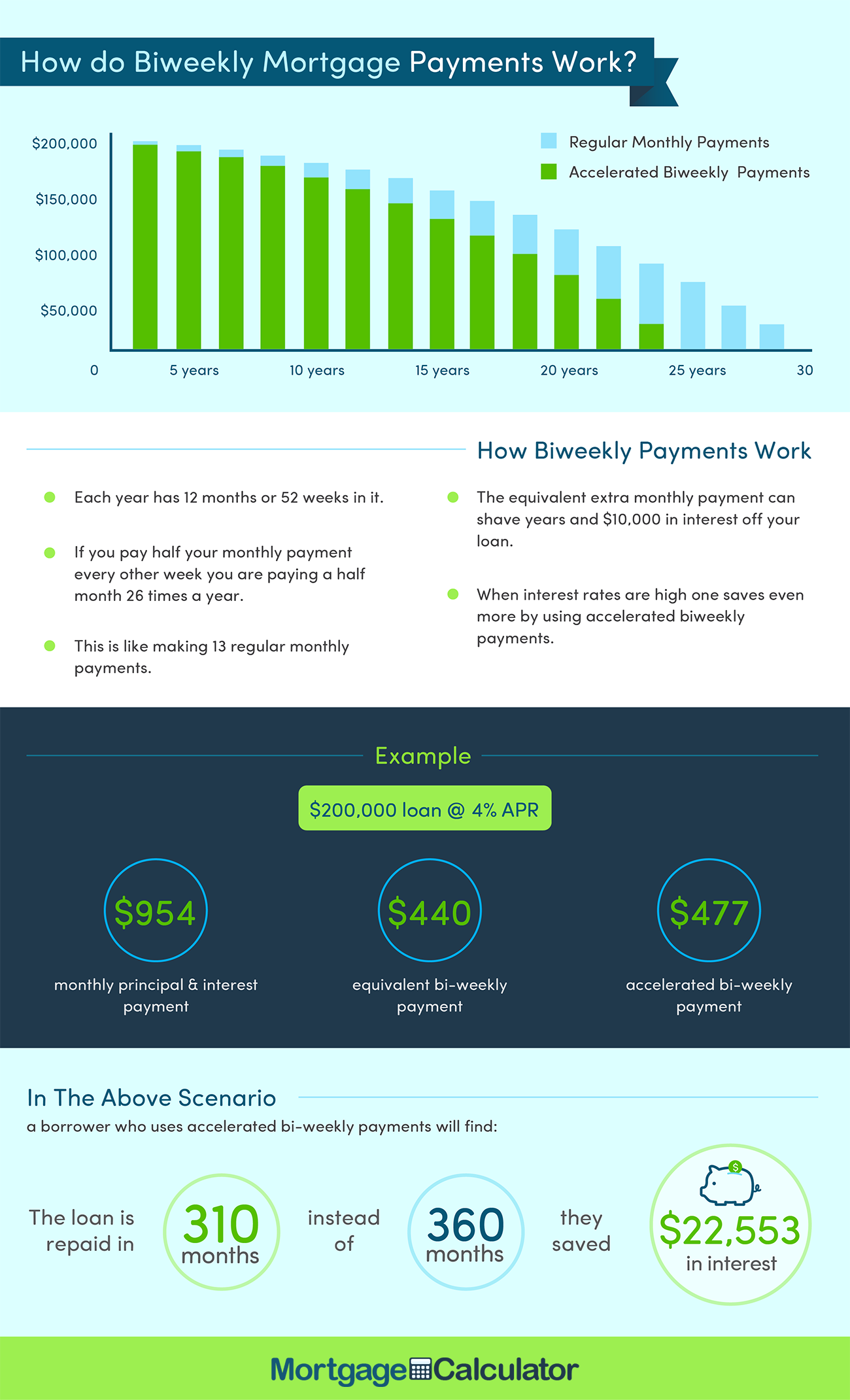

While a person on a bi-weekly payment schedule will receive two paychecks for ten months out of the year they will receive three paychecks for the remaining two months. Weekly bi-weekly semi-monthly and monthly. This Massachusetts hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Using our system you can easily generate. But when you start a new job youll have to fill out a W-4 form. Youll still need to apply for these benefits through your states unemployment insurance program but if you have questions about whether youre eligible for.

Our paycheck calculator is a free on-line service and is available to everyone. Monday July 4 Labor Day. A financial advisor in Connecticut can help you understand how taxes fit into your overall financial goals.

Federal Taxes Consistency in remittances gives you more credibility and your check stub calculator can save you. A bi-weekly every other week pay period results in 26 paychecks in a year. Monday June 20 Independence Day.

The following is the list of holidays on which the bank will be closed. A pay period is a recurring length of time over which employee time is recorded and paid. Calculate your Massachusetts net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Massachusetts paycheck calculator.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. This number is the gross pay per pay period. A weekly pay period results in 52 paychecks in a year.

Massachusetts is a flat tax state that charges a tax rate of 500. The accuracy or applicability of the tools results to your circumstances is not guaranteed. It can be a challenge to predict the size of your paycheck because money is deducted for FICA federal and state income taxes as well as other withholdings.

How You Can Affect Your Connecticut Paycheck. Because the coronavirus pandemic has left so many Americans jobless the federal government has given states more flexibility in granting unemployment benefits. That goes for both earned income wages salary commissions and unearned income interest and dividends.

No personal information is collected. This number is the gross pay per pay period. Your Vermont employer uses the information you provide on this form - with regard to your.

A 2020 or later W4 is required for all new employees. This is state-by state compliant for those states that allow the aggregate method or percent method of bonus calculations. Our paycheck calculator is a free on-line service and is available to everyone.

This tool has been available since 2006 and is visited by over 12000 unique visitors daily and has been utilized for numerous purposes. This calculator is provided only as a general self-help tool. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more.

Monday January 17 Presidents Day. The PaycheckCity salary calculator will do the calculating for you. Paychecks 12 per year while some are paid twice a month on set dates 24 paychecks per year and others are paid bi-weekly 26 paychecks per year.

Also a bi-weekly payment frequency generates two more paychecks a year 26 compared to 24 for semi-monthly. W4 Employee Withholding Certificate The IRS has changed the withholding rules effective January 2020. And affordable paycheck for your employees.

Payroll check calculator is updated for payroll year 2022 and new W4. No personal information is collected. It will calculate net paycheck amount that an employee will receive based on the total pay gross payroll amount and employees W4 filing conditions such us marital status payroll frequency of pay payroll period number of dependents or federal and state exemptions.

If your monthly paycheck is 6000 372 goes to Social Security and 87 goes to Medicare leaving you with 6000 372 87 5541. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes.

Employee Paycheck Calculator Worker Take Home Pay Calculator

Massachusetts Paycheck Calculator Tax Year 2022

Tip Tax Calculator Primepay

Payroll Software Solution For Massachusetts Small Business

The Final Pay Calculator Netchex

Massachusetts Paycheck Calculator Smartasset

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Hourly Paycheck Calculator Business Org

The Final Pay Calculator Netchex

Here S How Much Money You Take Home From A 75 000 Salary

Massachusetts Paycheck Calculator Smartasset

Massachusetts Paycheck Calculator Tax Year 2022

Paycheck Calculator Brand S Paycheck

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Payroll Software Solution For Massachusetts Small Business

Bi Weekly Loan Calculator Biweekly Payment Savings Calculator